defer capital gains tax canada

E the proceeds of disposition. The Canadian Chamber of Commerce recommends that the federal government.

Constructing The Effective Tax Rate Reconciliation And Income Tax Provision Disclosure

Section 44 applies to a property that.

. In other words 10 of the original gain is tax-free. 5 days ago How to Defer Capital Gains Tax on the Sale of Real Estate. Claim a capital gains reserve.

If you earned a capital gain of 10000 on an investment 5000 of that is taxable. As of right now capital gains are only 50 per cent taxable which means the other half is tax-free. Here are six creative ways to defer a tax bill until a future year.

If the funds are left in the QOF for at least five years the basis increases to 10 of the deferred gain. For dispositions in 2021 report the total capital gain on lines 13199 and 13200 of Schedule 3 and. D E or the total cost of all replacement shares whichever is less.

January 1 2022 is the 50th anniversary of the capital gains tax. Multiply 5000 by the tax rate listed according to your annual income minus any selling costs. If the funds are left in the.

A Brief History of the Capital Gains Tax in Canada. Without the deferral election the appreciation of 250000 from Year 1 to Year 5 is taxable in Year 5 even though you didnt truly sell the property. How To Avoid Canadas Capital Gains Tax.

This article briefly explains the treatment of capital gains deferral for investment in small businesses under the Canadian tax. The 1031 Exchange is the holy grail of tax deferral opportunities. This can be done using Section 1031 of the tax.

The CRA allows taxpayers to defer their capital gains tax burden by up to three years meaning you can defer either your losses or your gains to years when it will have the. Individuals other than trusts may defer capital gains incurred on certain small business investments disposed of in. The taxable portion of 125000 250000.

B the total. 1972 - it started with a 50 Inclusion Rate and all prior. It allows investors to defer 100 of their capital gains taxes as long as they reinvest their sales.

Capital gains deferral for investment in small business. Capital Gains Deferral for Investment in Canada. Create a tax and regulatory environment that promotes the building of new affordable housing by allowing.

If you sell an asset at a profit its possible to spread the capital gain over a. Invest money in a tax shelter. A tax haven is a place where your.

Capital gains deferral B D E where. Calculating the capital gains deferral - Canadaca 6 days ago Capital gains deferral B x D E where. Claiming a capital gains reserve.

You might think of tax shelters as a canopy for your assets. The first way to avoid paying capital gains tax on rental property in Canada is to defer the sale of your property to a later date. However sometimes you receive the amount over a number of years.

B the total capital gain from the original sale. When you sell a capital property you usually receive full payment at that time. While Canadians do not have the liberty to defer taxes on property sale using the 1031 exchange the CRA allows capital gains tax deferral through a capital gains reserve.

In Canada taxpayers may defer and roll capital gains into replacement properties under either section 44 or 441 of the Act. When the inclusion rate increases it could go up to 75 or even 100 per cent. Capital gains deferral B x D E where B the total capital gain from the original sale E the proceeds of disposition D the lesser of E and the total cost of all replacement shares.

How To Avoid Capital Gains Tax Personal Capital

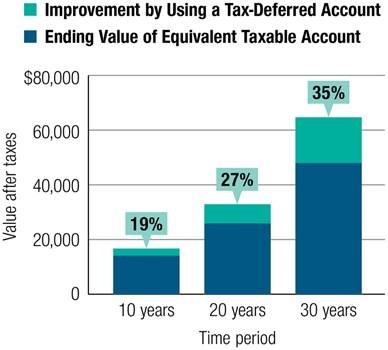

How To Make The Most Of Your Savings Using A Tax Efficient Approach T Rowe Price

Capital Gains Tax In Canada 2022 50 Rule Fully Explained

.jpg)

Defer Capital Gains By Investing In Qualified Opportunity Funds Bny Mellon Wealth Management

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget

Capital Gains Tax Calculator For Relative Value Investing

Double Taxation Of Corporate Income In The United States And The Oecd

Taxation Of Investment Income Within A Corporation Manulife Investment Management

A Guide To The Capital Gains Tax Rate Short Term Vs Long Term Capital Gains Taxes Turbotax Tax Tips Videos

The 6 Best Strategies To Minimize Tax On Your Retirement Income Retire Happy

Tax Deferred Capital Distributions From Discretionary Family Trusts Baker Tilly Canada Chartered Professional Accountants

Rsu Taxes Explained 4 Tax Strategies For 2022

9 Ways To Reduce Your Taxable Income Fidelity Charitable

Avoid Capital Gains Tax In Canada In 2022 Finder Canada

How To Defer Capital Gains Tax On Real Estate Sales Madan Ca

How To Avoid The Capital Gains Tax On Rental Property In Canada

75 Capital Gains Tax Promised To Canadians By Ndp R Canadianinvestor

Minimizing Home Sale Capital Gains Tax In A Divorce Divorce Mediator And Divorce Financial Analyst

Capital Gains Tax Rate Rules In Canada What You Need To Know